A Subtle Turn in the Wind: Decoding What’s Noise & What’s Structural in Today’s Market

- Cambridge Wealth

- Aug 3

- 4 min read

India’s economic narrative continues to be one of quiet strength, even as global uncertainties and geopolitical trade tensions resurface. Beneath the noise, structural indicators show a country increasingly fortified by its own engines: stronger balance sheets, deeper financial inclusion, expanding services, and disciplined policy management. Here’s a closer look at the key developments shaping India’s macroeconomy, equity markets, and debt landscape as we move into the heart of FY26.

MACROECONOMY: STABILITY IS THE STORY

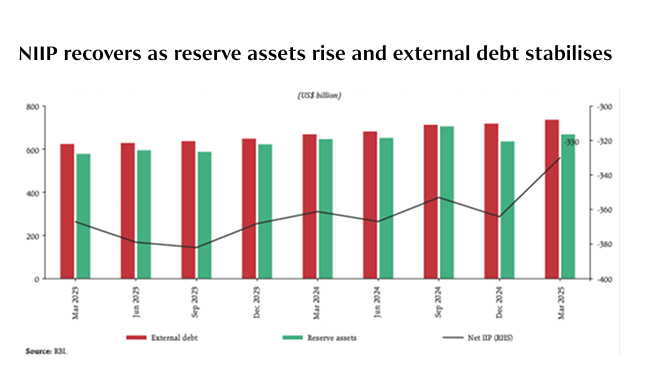

1. External Resilience Improving Meaningfully: India’s net international investment position (NIIP) improved to US$330 billion in Q4 FY25, from US$364 billion the previous quarter. This US$34 billion improvement isn’t just about currency gains, it reflects India’s improving fiscal and external health through higher forex reserves, stronger outward FDI, and increased overseas currency and deposit holdings. In simple terms: India’s liabilities to the world are shrinking. This strengthens the rupee’s credibility, enhances our creditworthiness, and adds to macroeconomic stability—especially important at a time when global flows are more sensitive to risk.

2. Trade Friction Resurfaces But the Impact is Contained: The US’ decision to raise tariffs by 25% on some Indian exports, including textiles and chemicals, marks a clear signal of shifting trade equations. But it’s unlikely to derail India’s broader economic momentum. Export-linked sectors may feel the heat in the near term, but with domestic demand driving the bulk of GDP growth and India’s measured diplomatic playbook, the long-term impact should be marginal. This is a skirmish, not a structural setback.

3. Financial Inclusion Reaches New Depths: India’s Financial Inclusion Index rose to 64.2 in 2024, up from 49.9 in 2019. This remarkable progress is the result of policy-backed digital innovation: UPI penetration, JAM trinity (Jan Dhan, Aadhaar, Mobile), and now the Account Aggregator framework. The outcome? A broader base of citizens now have access to formal banking, credit, insurance, and investments.

This deep inclusion is not just a social win—it’s a growth multiplier, unlocking new consumption, entrepreneurship, and rural economic participation that can fuel a longer economic cycle.

EQUITY MARKETS: LEADERSHIP IS BROADENING

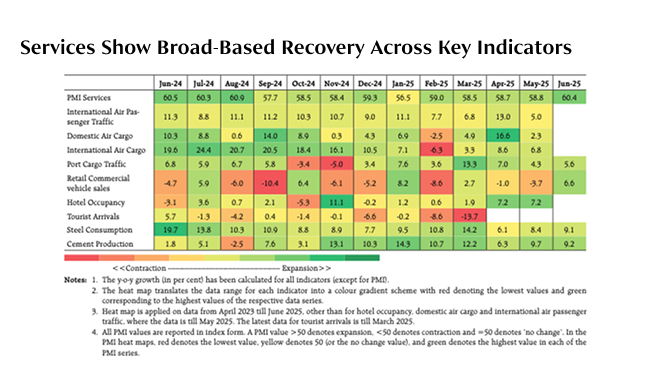

1. Services Drive a Wave of Earnings Visibility: India’s services sector—long the unsung hero of our growth story—is showing strong momentum. A visible pickup in rural and urban demand across May–June FY26 is fueling growth in FMCG, BFSI, auto, and infrastructure. More importantly, these aren’t one-off spikes; they’re signs of broad-based earnings strength, which is helping support elevated market valuations.

For equity investors, this signals greater predictability—and that’s a key driver of long-term capital allocation.

2. Public Capex is Doing the Heavy Lifting: While private sector capex remains uneven, the government’s aggressive spending push in Q1 FY26 is proving to be a major tailwind. Sectors like capital goods, cement, steel, infra, and logistics are directly benefiting. Even more, this public capex is likely to act as a catalyst for private investment to follow—creating a strong pipeline of activity for FY26 and FY27.

For equity markets, this translates to earnings upgrades in sectors that had previously been in wait-and-watch mode.

3. Midcaps Take the Lead in Market Performance: Midcap and smallcap stocks are seeing strong flows from both domestic institutions and retail investors. What’s more interesting is the selectivity of these flows—investors are backing companies with exposure to rural demand, digital services, niche manufacturing, and clean-tech.

The broadening of market leadership beyond Nifty giants is a sign of a healthy bull cycle, where capital is flowing toward innovation, quality, and future-facing themes.

DEBT MARKETS: ENTERING A GOLDILOCKS ZONE

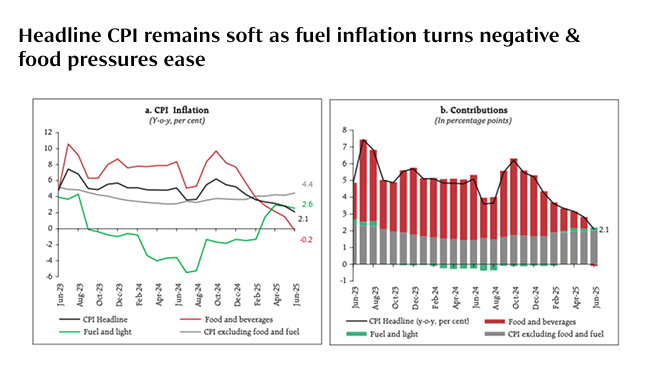

1. Sub-4% Inflation Could Open the Door for Rate Cuts: India has seen five consecutive months of CPI inflation below 4%, driven by falling food prices and stable core inflation. With inflation well within the RBI’s target range, there is increasing room to consider a rate cut if global conditions remain supportive.

This could be a positive inflection point for interest-sensitive sectors like NBFCs, real estate, and consumer durables, while also supporting smallcaps that benefit from easier credit and lower funding costs.

2. Liquidity Support Keeps Yields Soft: The RBI’s proactive stance in maintaining surplus liquidity has helped ease credit conditions across the board. This is enabling faster transmission of earlier rate actions, improving cash flow conditions for borrowers, and keeping yields soft—especially in short-to-mid duration instruments.

For debt investors, this creates opportunities in G-Secs, SDLs, and high-quality AAA bonds, where real returns look attractive relative to risk.

3. Infrastructure Lending Norms Relaxed: In a notable structural move, the RBI has relaxed norms for infrastructure financing. This paves the way for long-term bond issuance by infra companies, a move that could steepen the yield curve.

While this benefits infrastructure players looking to raise capital, it also presents a new opportunity for investors seeking long-duration exposure in portfolios as part of a barbell or ladder strategy.

What Should Investors Do Now?

India’s economic engine continues to fire on multiple cylinders—resilient consumption, stable inflation, expanding credit, and proactive policymaking. While global headwinds like the US tariff decision may occasionally shift sentiment, they don’t weaken the core structure of India’s growth story.

For investors, this is a time to remain balanced but optimistic:

Equity: Broaden exposure beyond large caps—consider quality midcaps, infra, and consumption-driven sectors.

Debt: Stay invested in short-to-mid duration quality debt; consider opportunistic allocations to infra bonds or dynamic bond funds if rate cuts emerge.

Macro lens: Pay attention to domestic engines over global noise. India’s positioning is no longer that of a fragile economy reacting to global moves—it’s becoming a base of its own.

Final Take:India is not immune to external shocks—but it’s far more prepared than it once was. The macro fundamentals are intact. The market breadth is widening. And the investment landscape remains rich with opportunity for those who stay patient, stay invested, and stay discerning.

Comments