The Paradox of Prosperity: India's Growth Story Amid Global Tariffs

- Cambridge Wealth

- Oct 1, 2025

- 7 min read

Updated: Oct 2, 2025

In a world marked by trade wars, fiscal strains, and global uncertainty, India’s story is starting to read differently.

The GST reforms of September go beyond tax realignment, they signal a shift toward an economy that’s leaner, more productive, and better positioned for sustained growth.

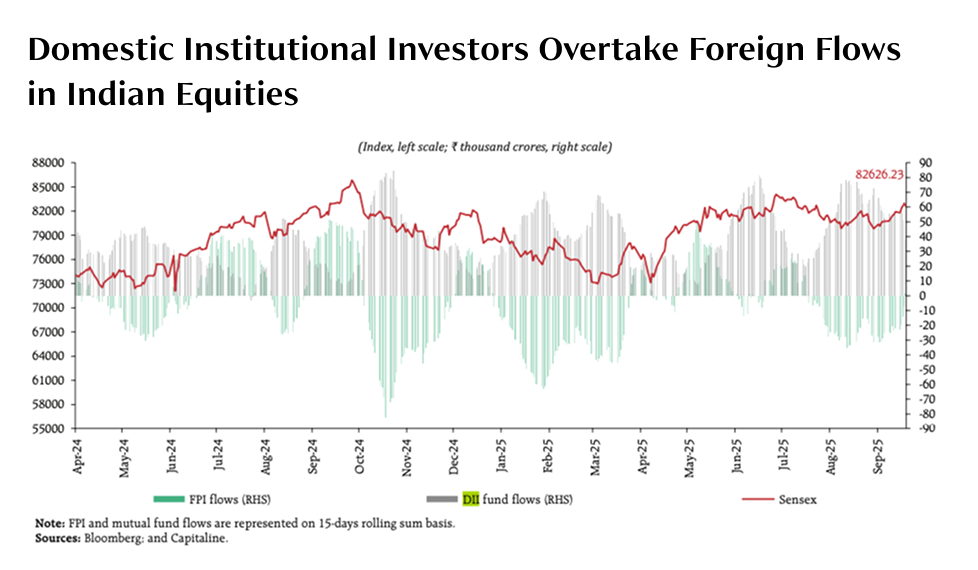

At the same time, a turning point has arrived: Domestic institutions now own more equity than foreign investors. That’s not just a statistic, it reflects rising savings, growing confidence, and a market that’s learning to stand on its own strength.

Of course, risks remain, tariffs, volatile commodities, and the pressure to sustain productivity. But unlike earlier cycles, India comes prepared this time: stronger reserves, a contained deficit, and policies that transmit more effectively.

As Dani Rodrik put it, real strength lies not just in weathering storms but in building institutions that last. India’s reforms and resilience show a country actively shaping its future, creating opportunities that feel both durable and investable.

Export Flexibility as Strategic Advantage: India’s ability to maintain 6.7% YoY merchandise export growth despite 50% US tariffs reveals more than short-term resilience, it reflects a structural diversification across products, markets, and global supply chains. Sectors like generic pharmaceuticals & electronics illustrate India’s move from low-value to high-value exports, showing that global shocks now test adaptability rather than vulnerability.

Domestic Demand as a Shock Absorber: Q1 GDP growth of 7.8% YoY underscores how consumption and investment now act as buffers against global volatility. High household savings, rising urbanization, and capex recovery suggest a domestic economy increasingly self-sustaining. This points to a critical insight: India’s growth trajectory is less tethered to global sentiment and more anchored in domestic productivity and spending patterns.

Policy as Long-Term Game Changer: GST reforms are not merely tax tweaks, they are strategic enablers of efficiency, formalization, and fiscal stability. By rationalizing rates and incentivizing compliance, the reforms strengthen India’s institutional backbone, reduce informal economic drag, and enhance the economy’s capacity to generate sustainable public and private investment.

Shift from FPI Reliance to Domestic Anchoring: DIIs surpassing FPIs signals a behavioral shift in Indian markets. Domestic investors are increasingly driving price discovery, reflecting rising financial literacy, stronger institutional frameworks (like mutual funds and pension funds), and deeper alignment with long-term growth. Markets are moving from volatility-driven trading toward fundamentals-driven investment, a hallmark of mature markets.

Policy Reforms as Confidence Drivers: Equity markets are now more responsive to policy clarity and macro fundamentals than headline shocks. S&P’s sovereign rating upgrade and GST reforms triggered strong rebounds, while transient global shocks (US tariffs) caused only limited correction. This shows an emerging sophistication among domestic investors, who can distinguish between cyclical noise and structural opportunity.

Neutral Stance, Selective Equity Positioning: The equity market’s differentiated response across sectors highlights how structural reforms create selective growth opportunities. Consumption-linked sectors, financials, and domestic-oriented industrials benefit from policy-led demand, while export-heavy segments reflect hedged exposure to global volatility, a trend investors can strategically leverage.

Inflation Discipline as an Economic Lever: CPI at 2.1% and core inflation at 4.2% indicate structurally low inflation, not just a cyclical pause. Controlled inflation enhances consumption power, lowers risk premia, and enables the RBI to maintain accommodative policy, creating a virtuous cycle of growth without overheating.

Effective Monetary Transmission Reflects Financial Maturity: Repo rate cuts translating to meaningful reductions in lending and deposit rates show deepening financial intermediation and policy efficacy. This indicates that liquidity interventions now efficiently reach real sectors, strengthening the feedback loop between monetary policy and growth outcomes.

Credit System Diversification as a Stability Factor: Strong bank and non-bank credit growth (10.3% YoY) demonstrates multiple channels sustaining investment flow, reducing reliance on any single financial source. This diversified credit ecosystem mitigates systemic risk, supports capex recovery, and ensures that sectors critical to structural growth, like manufacturing, infrastructure, and services, receive uninterrupted funding.

DISCLAIMER

This Confidential Document has been prepared by Cambridge Wealth (hereafter referred to as CW). The information and opinions contained in this document have been complied or arrived at by CW from published sources which we believe to be reliable and accurate and in good faith but which, without further investigation, cannot be warranted as to their accuracy completeness or correctness. All information, opinions and estimates contained in this document should be considered as preliminary and indicative, veracity of which cannot be ascertained without further detailed information availability and analysis. The information contained in this Document is selective and is subject to updation, expansion, revision and amendment. CW has not independently verified any of the information and data contained herein. While the information provided herein is believed to be accurate and reliable, CW (nor any of their respective affiliates, subsidiaries, advisors and agents thereof) does not make any representations or warranties, expressed or implied, as to the accuracy or completeness of such information and data. Nothing contained in this Document is, or shall be relied upon, as a promise or representation by CW. In furnishing this Document, CW reserves the right to replace or amend the Document at any time. This Document may contain statements regarding CW and or the management's intentions, hopes, beliefs, expectations or predictions of the future that are forward looking statements. It is important to note that the actual results could differ materially from those projected in such forward-looking statements. The factors among others that cause actual results to differ materially from those in the forward-looking statements

The information, data or analysis does not constitute investment advice or as an offer or solicitation of an offer to purchase or subscribe for any investment or a recommendation and is meant for your personal information only and suggests a proposition which does not guarantee any returns. Baker Street Fintech Pvt. Ltd. (hereinafter referred as BKL) or any of its affiliates is not soliciting any action based upon it. This information, including the data, or analysis provided herein is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. The historical performance presented in this document is not indicative of and should not be construed as being indicative of or otherwise used as a proxy for future or specific investments. The relevant product offering documents should be read for further details. BKL does not take responsibility for authentication of any data or information which has been furnished by you, the entity offering the product, or any other third party which furnishes the data or information. The above mentioned assets are not necessarily maintained or kept in custody of BKL. The information contained in this statement are updated as and when received as a result of which there may be differences between the details contained herein and those reflected in the records of the respective entities or that of yours. In the event where information sent through any electronic Media (including but not limited to Net Banking or e-mail) or print do not tally, for whatever reason, with the records available with the entity offering the product or the third party maintaining such information in each of the foregoing cases, the information with the entity offering the product or third party maintaining such information shall be considered as final. The benchmarking shown in document above is a result of the choice of benchmark BKL uses for the various products. It is possible that some investments offered by the third parties have other benchmarks and their actual relative under- or out-performance is different from that provided in the statement. The recipient should seek appropriate professional advice including tax advice before dealing with any realised or unrealised gain / loss reflecting in this statement. The above data, information or analysis is shared at the request of the recipient and is meant for information purpose only and is not an official confirmation of any transactions mentioned in the document above. Service related complaints may be acceptable for rectification of inaccurate data. You should notify us immediately and in any case within 15 days of receipt of this document date if you notice any error or discrepancy in the information furnished above, failing which it would be deemed to have been accepted by you. BKL reserves the right to rectify discrepancies in this document, at any point of time. The sharing of information in relation to one’s assets may not be secure and you are required to completely understand the risk associated with sharing such information. The information being shared with BKL can pose risk of information being stolen and or used by unauthorised persons who do not have the rights to access such information. FSL or any of its group companies, its employees, and agents cannot be held liable for unauthorised use of such information. Our sales professionals or other employees may provide oral or written views to you that reflect their personal opinions which may be contrary to the opinions expressed herein. You should carefully consider whether any information shared herein and investment products mentioned herein are appropriate in view of your investment experience, objectives, financial resources, relevant circumstances & risk appetite. All recipients of this Information should conduct their own investigation and analysis and should check the accuracy, reliability and completeness of the Information .This Information is distributed upon the express understanding that no part of the information herein contained has been independently verified. Further, no representation or warranty expressed or implied is made nor is any responsibility of any kind accepted with respect to the completeness or accuracy of any information as may be contained herein. In no event will BKL and their officers, directors, personnel, employees or its affiliates and group company be liable for any damages, losses or liabilities including without limitation, direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your use of the information mentioned in this document or your reliance on or use or inability to use the information contained in this document, even if you advise us of the possibility of such damages, losses or expenses. The contents of this document do not have any contractual value. The information contained in this document is confidential in nature and you are receiving all such information on the express condition of confidentiality. If you are not the intended recipient, you must not disclose or use the information in this document in any way whatsoever. If you received it in error, please inform us immediately by return e-mail and delete the document with no intention of its being retrieved by you. The information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of BKL. While every effort has been made to ensure that the information provided herein is accurate, timely, secure and error-free, BKL, their partners, directors, promoters, employees, agents and assigns shall not in any way be responsible for any loss or damages arising in any contract, tort or otherwise from the use or inability to use this information and its contents. Any material downloaded or otherwise obtained through the use of the website or email is at your own discretion and risk and you will be solely responsible for any damage that may occur to your computer systems and data as a result of download of such material. Any information sent from BKL to an e-mail account or other electronic receiving communication systems/ servers, is at your risk.

Comments