Navigating Global Crosscurrents: Investment Outlook Sept'25

- Cambridge Wealth

- Sep 2

- 3 min read

A question dominating market conversations: Can India’s markets hold their ground as global headwinds intensify?

Recent weeks have seen tariff shocks, commodity swings, and uneven industrial activity unsettle sentiment, pressures felt most in export-linked sectors. Even the boost from the updated GST framework, applauded for its focus on efficiency, could not offset the broader decline.

Yet beneath the noise, the story is different. Inflation has eased to multi-year lows, the monsoon has revived rural demand, and S&P’s rating upgrade has reaffirmed confidence in India’s resilience. As the RBI notes, financial conditions remain “congenial and supportive of domestic activity” a reminder that short-term shocks may unsettle, but long-term strengths continue to power India’s growth. Our role is to cut through the noise, staying alert to risks while anchoring portfolios to these durable drivers.

Macroeconomy

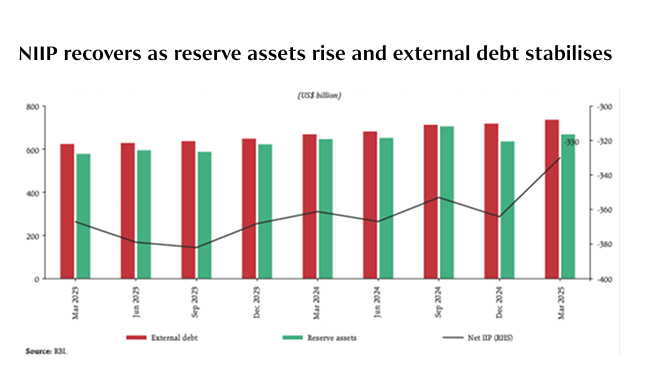

1. External Resilience at Record HighsIndia’s foreign exchange reserves climbed to US$ 689 billion by mid-August 2025, the highest in nearly two years, and now provide cover for over 11 months of imports. This build-up has been supported by strong capital inflows, robust remittances, and a narrowing current account deficit. Combined with S&P’s sovereign rating upgrade, these reserves reinforce India’s credibility in global markets and strengthen buffers against external shocks such as oil price volatility or capital outflows.

2. Trade Pressures, Strategic IntegrationThe additional 25% US tariff on Indian exports has pressured trade prospects in sectors such as textiles, chemicals, and engineering, triggering near-term uncertainty. However, India is responding with calibrated diplomacy while diversifying trade ties with ASEAN, Africa, and West Asia. At the same time, strong domestic consumption and resilient services exports provide a cushion, ensuring that growth remains anchored even as global trade dynamics shift.

3. Monsoon-Led Rural MomentumThe timely and even progress of the southwest monsoon has boosted kharif sowing, improving prospects for agriculture output. This comes at a crucial moment when industrial activity has shown uneven momentum. Rural consumption, which was already resilient in July despite weak electricity demand and subdued industrial output, is set to gain further traction. With nearly two-thirds of India’s population linked to agriculture, this monsoon lift provides a credible cushion for domestic demand and helps sustain GDP growth.

Equity

1. Earnings Resilience in Q1 FY26: The Q1 FY26 earnings season has been broadly resilient, with growth led by BFSI, Technology, Oil & Gas, Cement, and Utilities, which together contributed 71% of incremental earnings growth. Of the 38 Nifty companies reporting so far, PAT grew 7.5% YoY, slightly ahead of the 5.7% estimate. This resilience reflects strong credit growth in BFSI, healthy order books in cement and infra-linked sectors, and stable margins in IT despite global headwinds.

2. Policy Reforms as Confidence Drivers: Equities staged a brief rebound in mid-August on the back of India’s sovereign rating upgrade and the announcement of GST reforms aimed at simplification and compliance. While tariff-related concerns soon weighed on sentiment again, these reforms provide medium-term structural benefits. They are expected to broaden the tax base, boost fiscal revenues, and improve investor confidence, factors that could help sustain equity valuations even in a volatile global setting.

3. Neutral Stance, Selective Equity Positioning: India continues to stand out in the global equity landscape with steady GDP growth, benign inflation, ample liquidity, and healthier corporate balance sheets. However, the imposition of US tariffs may pressure exports and the balance of payments, keeping global uncertainties in focus. Domestic earnings remain firm, but mid- and small-cap valuations appear stretched. Our stance remains neutral overall, with preference for large-cap exposure where valuations are more reasonable, while maintaining selective positions in quality mid- and small-cap names.

Debt

1. Inflation at Multi-Year LowsHeadline CPI inflation fell for the ninth consecutive month in July, reaching its lowest level since June 2017, driven largely by food price deflation. This cooling has boosted household purchasing power, improved real incomes, and created a comfortable backdrop for monetary policy. With inflation consistently below 4%, markets are beginning to price in a potential rate-cut cycle in the months ahead.

2. Sovereign Rating Upgrade Reinforces StabilityThe sovereign rating upgrade by S&P has reinforced global confidence in India’s macro stability. The rupee, which had seen a marginal depreciation in July due to FPI outflows, regained strength in August on the back of the upgrade. With forex reserves now covering nearly nine months of imports, India’s external position is more resilient, reducing risks of sudden capital flight and currency volatility.

3. Yields Supported by Liquidity and InflationThe debt market continues to be underpinned by favourable conditions. Banking system liquidity remains high, averaging ₹3 lakh crore in daily surplus, which, alongside the sharp fall in inflation, has kept yields on short-to-mid maturity bonds soft. This creates a supportive environment for government securities and high-quality AAA-rated corporate bonds, which are serving as reliable income anchors in portfolios while offering a stable carry in an otherwise uncertain global interest rate backdrop.

Comments